EL PASO, Texas, Oct. 16, 2017 – Hunt Companies Inc. today announced that it has successfully closed on an agreement with Alden Torch Financial to acquire its syndication division, Alden Capital Partners.

The firm, to be renamed Hunt Capital Partners, will focus on in the syndication of Federal and State Low-Income Housing, Historic and Solar Tax Credits. Hunt Capital Partners was an affiliate of Hunt until it was sold to create Alden Capital Partners in 2015.

Executive leadership will transition to Hunt as part of the transaction, including:

"We are pleased to welcome Hunt Capital Partners back into the Hunt Family of Companies," said Hunt CEO Chris Hunt. "This acquisition represents our continued commitment to the affordable housing industry."

Earlier this year, Hunt completed an investment in Pennrose Properties, LLC, a leading affordable housing developer. Currently, Hunt is working as the development partner with housing authorities across the country to deliver more than 6,600 units. Hunt is also a leader in the U.S. Department of Housing and Urban Development’s Rental Assistance Demonstration (RAD) program.

"As we continue to grow our affordable housing syndication business, re-establishing our partnership with Hunt provides Hunt Capital Partners with a broader range of tools to help serve our developer and investor clients across the affordable housing industry," said Jeff Weiss, president of Hunt Capital Partners.

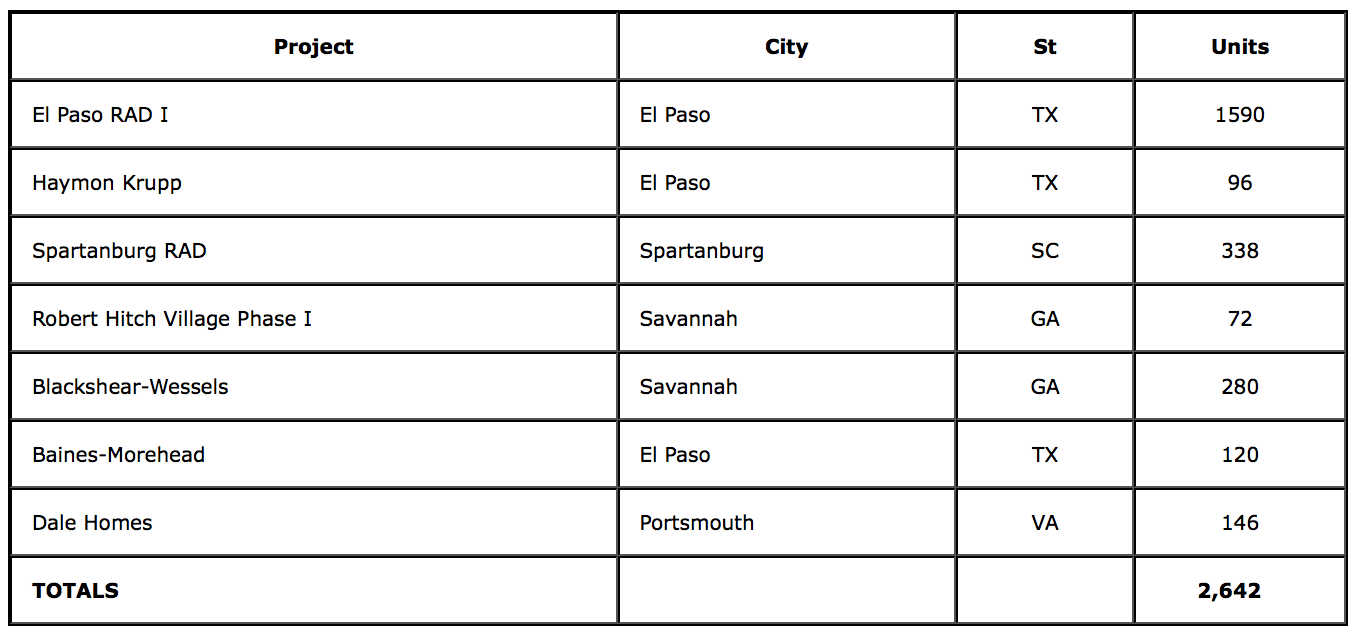

Since the successful launch of its first low-income housing tax credit (LIHTC) syndication fund in 2011, Hunt Capital Partners, formerly Alden Capital Partners, has raised over $1.35 billion in LIHTC equity. The platform has 35 institutional investors and investments in 41 states, the U.S. Virgin Islands and Puerto Rico. Hunt and the principals of the renamed Hunt Capital Partners continued working together on the development and syndication of affordable housing under Hunt’s RAD initiatives following the sale in 2015. This ongoing collaboration has, to date, successfully arranged the syndication of seven RAD developments involving over $150 million in federal and state LIHTCs. The projects include:

# # #

About Hunt

Founded in 1947, Hunt Companies, Inc. is today a holding company that invests in business focused in the real estate and infrastructure markets. The activities of Hunt’s affiliates and investees include investment management, mortgage banking, direct lending, loan servicing, asset management, property management, development, construction, consulting and advisory. To learn more about Hunt, please visit www.huntcompanies.com.