Our History

Values that Build. Since 1947.

For more than 75 years, Hunt Companies has grown from a regional lumber and hardware business supporting construction projects into a diversified platform spanning real estate, infrastructure, and financial services. Our history is more than a timeline—it’s a reflection of the values that guide us and the milestones that shape our journey.

From our earliest developments to transformative partnerships and strategic acquisitions, each chapter has laid the foundation for continued growth. As we look ahead, we remain committed to evolving with purpose, creating lasting impact, and building a future that honors our past.

The Beginning

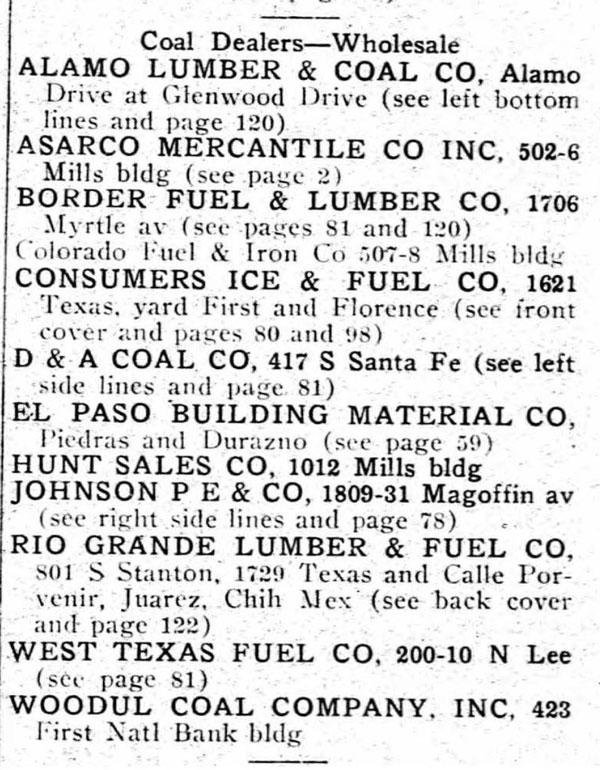

M.L. Hunt arrives in El Paso working as a wholesale and retail dealer in coal.

The Beginning

M.L. Hunt forms Hunt Sales Company, a wholesale coal company and manufacturers' agent.

The Beginning

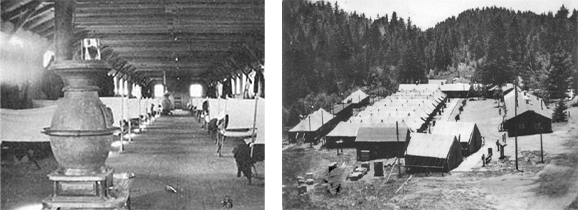

During the Great Depression, M.L. Hunt won contracts to haul coal to Civilian Conservation Corps camps in Arizona and New Mexico.

The Beginning

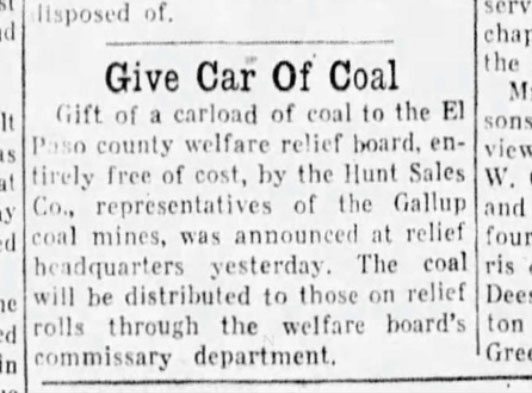

Hunt Sales Company provides El Paso County Welfare Relief Board with a carload of coal.

A Vision of the Future

M.L. Hunt purchases the interest of Alex Gonzalez's general store in Ysleta, in El Paso's Lower Valley.

The Company Begins

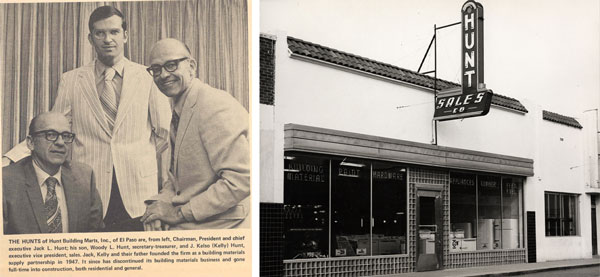

Upon returning from their naval service in WWII, M.L. Hunt's sons, Jack and Kelly, join their father in the business... and Hunt as a company officially begins.

The Company Begins

In the years that follow, the Company moves locations and expands to include construction and remodeling services in addition to selling lumber, building material, hardware, appliance and farm supplies.

Our Founders

M.L. Hunt retires and sells his interest in the Company to Jack and Kelly Hunt.

Evolution

The Company's name is changed to Hunt Building Marts, Inc.

Evolution

Hunt Building Marts, Inc. forms a partnership to include architecture, design-build and general contractor services for schools, car dealerships, and civic projects.

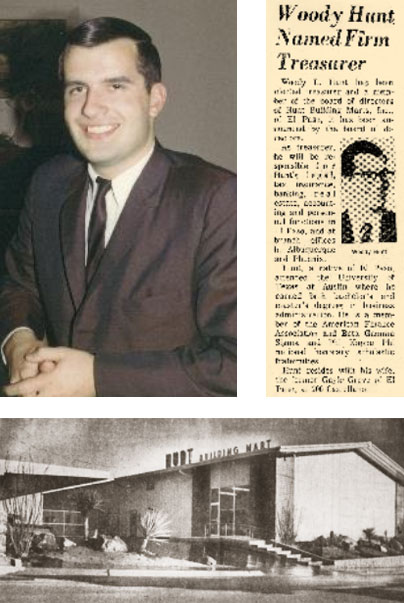

Evolution

Jack's son, Woody L. Hunt, joins the business and becomes treasurer of Hunt Building Marts, Inc.

Expanding Services

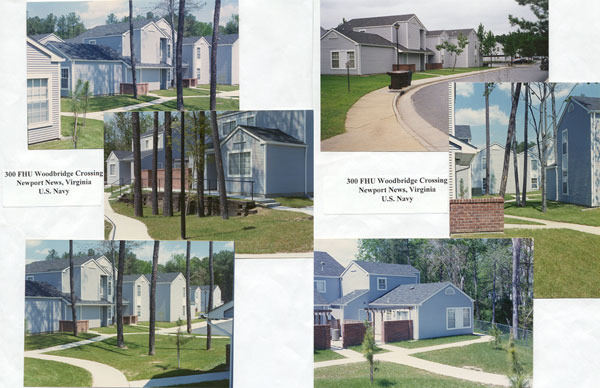

Hunt signs its first military housing contract to construct 300 units of base housing at Holloman Air Force Base in New Mexico.

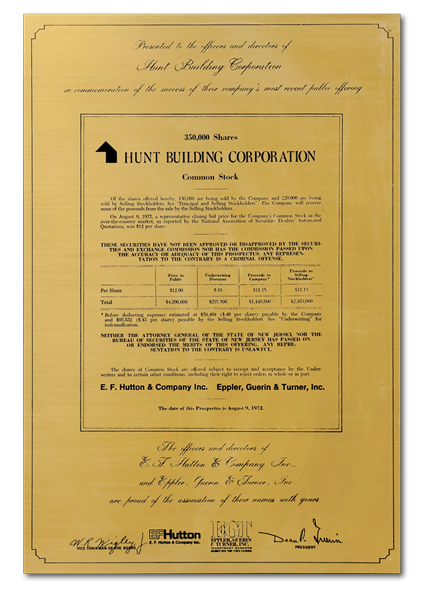

A Public Venture

The Company becomes a national firm, working outside of the El Paso region. Hunt, in order to raise capital and expand, sells shares and becomes a public company. Followed by an additional stock sale in 1972.

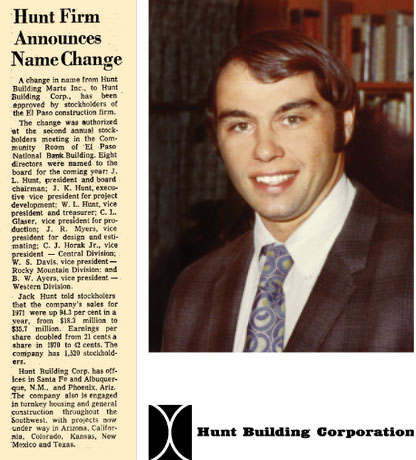

A New Name

The Company changes its name to Hunt Building Corporation and adds development and financial services to its capabilities. Jack's son, Mike Hunt, joins as a field engineer.

Military Housing Contract

Hunt is awarded a contract with the U.S. Army for 1,000 housing units at Fort Hood, positioning Hunt as a leader in military housing construction.

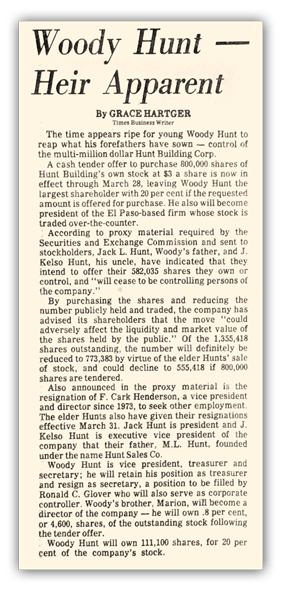

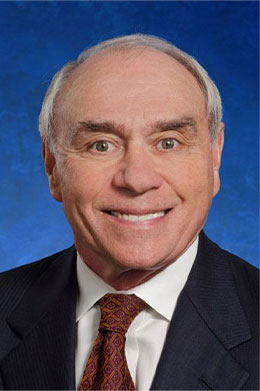

A New President

The Company purchases back all publicly held stock as well as Jack and Kelly Hunt's interests. Jack and Kelly Hunt retire, and Woody L. Hunt becomes controlling shareholder, President and Chairman of the Company.

Private Development

Hunt begins its private development activities with Caprock Apartments, a 292-unit complex in El Paso, Texas.

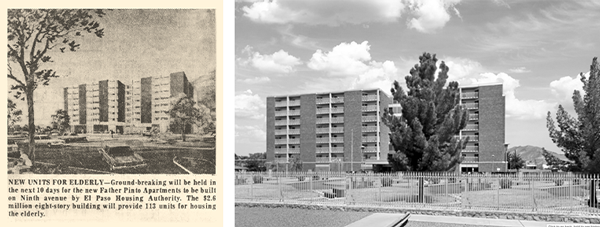

21 New HUD Projects

The Company begins a four year development and construction project on 21 HUD Section 8 projects.

Property Management

Hunt starts its property management division with Shady Oaks in Fort Worth, Texas, a 138-unit affordable housing community developed, built, and owned by Hunt.

Military Housing

Hunt begins its role as contractor, developer, financier, and owner, having been awarded the first of six 801 military housing contracts totaling 3,170 units.

Military Housing

Five years later, Hunt secures the first and only 802 project for construction of affordable housing in Hawaii.

A New President

Mike Hunt is elected President and Chief Operating Officer of Hunt Building Corporation.

Foundation Created

Woody and Gayle Hunt establish the Cimarron Foundation - now known as the Woody and Gayle Hunt Family Foundation.

Private Real Estate Growth

Hunt continues its private real estate development with the first phase of Colinas del Sol. At completion, this 752-unit market-rate multifamily project commanded the highest rental rates in El Paso, Texas.

Development Expands

Chris Hunt, Mike Hunt's son, joins the Company working on various development projects.

New Retail Projects

Hunt enters into retail development with the construction of the Sunland Towne Center, a 325,000 square-foot power center in El Paso, Texas, and in the following year, as Master Developer for The Plaza at Cottonwood, a 425,000 square-foot center in Albuquerque, New Mexico.

New LIHTC Development

Hunt begins construction and development of Low-Income Housing Tax Credit (LIHTC) projects.

Become An MHPI Leader

Hunt becomes one of the industry's largest MHPI developers and owners with the award of four Military Housing Privatization Initiative (MHPI) projects, which include Robins Air Force Base in Georgia; Dyess Air Force Base in Texas; Camp Pendleton MCB in California; and NAS Kingsville in Texas.

Master-Planned Communities

Hunt begins the development of single-family lots in El Paso, Texas. Over the decades that follow, the Company breaks ground on other projects in El Paso and near Austin, Texas. Hunt has developed or is developing 29,593 homes on over 9,800 acres. These developments continue to this day.

Growth in Hawai'i

Hunt is selected by the Navy as the Master Developer for Ford Island in Hawaii, providing significant infrastructure improvements and redevelopment of 1,600 acres of land. This project continues to this day.

Continued Expansion

Josh Hunt, Woody's son, joins the business working on developing ABQ Uptown in Albuquerque, New Mexico - the company's first lifestyle center.

U.S. Airforce Projects

Hunt is awarded the largest Air Force MHPI project, located at three different military installations.

Our New Brand

Hunt Building Corporation changes its name to Hunt Companies, Inc.

A Strategic Change

Hunt ventures into multiple related lines of businesses and transitions into a holding company structure. The Company buys a majority interest in TRECAP Partners, and expands its real estate investment management business. TRECAP (later called Hunt Investment Management, an SEC-registered investment advisor) then acquired Capmark Investments' $4.3 billion real estate equity investment management business.

Additional LIHTC

Hunt expands its Low Income Housing Tax Credit (LIHTC) business with the formation of Hunt Capital Partners, an affordable housing syndication and investment company.

Gayle Grave Hunt School of Nursing

The Woody and Gayle Hunt Family Foundation donates $10 million to the Texas Tech University Health Sciences Center to establish the Gayle Greve Hunt School of Nursing.

Hunt Institute for Global Competitiveness

The Woody and Gayle Hunt Family Foundation donates $6 million to establish the Hunt Institute for Global Competitiveness at The University of Texas at El Paso.

A New Affiliate

Hunt makes a strategic investment in LEDIC Management Group (later renamed Envolve), a multifamily investment and property management company.

Affordable Housing

Hunt closes on the purchase of Capmark Financial Group's affordable housing portfolio, acquiring partnership interests and other assets associated with over 74,000 units of affordable-to-moderate income housing at more than 400 properties across the U.S.

Social Impact Investment

Woody and Josh Hunt, in a joint venture with another El Paso family, form MountainStar Sports Group. The move is central to Hunt's overall strategy to improve the quality of life and economic development in the Borderplex region. Several significant social impact investments will be made in the years that follow through this entity.

Social Infrastructure

Hunt acquires the Carter Goble Lee companies expanding its capabilities in social infrastructure. The newly formed company is reorganized and consolidated to form CGL Management Group.

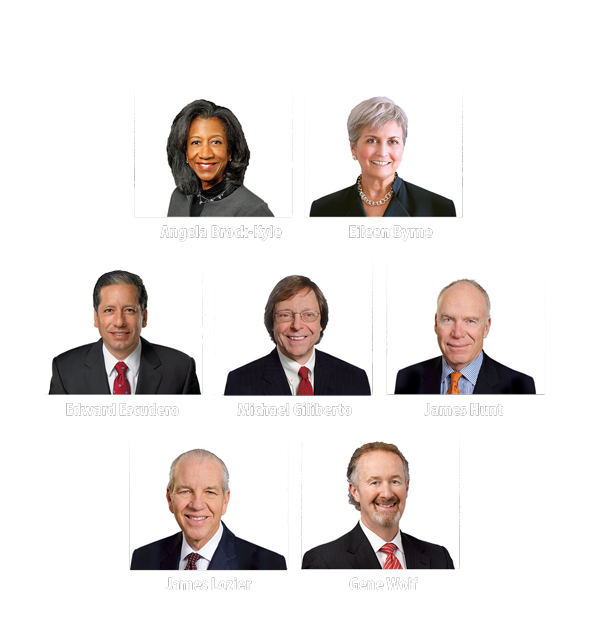

Corporate Governance

Hunt continues to transition to holding company structure, providing the highest standards of corporate governance with external board members, best-in-class affiliates, and skilled leadership at every level.

Acquisition and Growth

Hunt completes the acquisition of Centerline Holding Company, later renamed Hunt Mortgage Group. The acquisition approximately doubles the number of units in the affordable housing portfolio and provides a licensed lending platform.

Construction Services Expansion

Hunt purchases a 40% interest in Moss Construction and integrates Hunt's construction operations with the Florida-based firm.

Multifamily Management

Hunt becomes the majority owner of Pinnacle Management Services, LLC, a leading multifamily management company.

Strategic Disposition

Hunt completes the sale of its affordable housing/Low-Income Housing Tax Credit platform. In less than five years, Hunt Capital Partners (and related entities) create the premier affordable housing asset management platform. The proceeds are redeployed to strategic opportunities in public infrastructure, mortgage banking, and commercial real estate. Two years later, Hunt buys back the tax credit syndication arm of the platform and names it Hunt Capital Partners.

International Expansion

Hunt finalizes strategic investment in Amber Infrastructure Group, a specialist international investment manager based in London.

Leadership Transitions

Chris Hunt becomes Chief Executive Officer of the Company and Woody L. Hunt transitions to the role of Executive Chairman of the Company's Board of Directors.

Continued Leadership in Military Housing

Hunt acquires Forest City's privatized military housing business, increasing the Company's owned and managed privatized military housing units to approximately 52,000 and 32,000, respectively.

Woody L. Hunt School of Dental Medicine

The Woody and Gayle Hunt Family Foundation donates $25 million to Texas Tech to establish the Woody L. Hunt School of Dental Medicine in El Paso, Texas.

A New Partner

Hunt forms a strategic alliance with Pennrose Properties, LLC, integrating Hunt's affordable housing operations with the Pennsylvania-based firm.

Multi-State Growth

Hunt achieves milestones on luxury multifamily ventures in Texas, Florida, Illinois, Arizona, and Virginia.

Capital Transitions

Hunt sells Hunt Real Estate Capital, formerly Hunt Mortgage Group, to Tokyo-based ORIX Corporation. The transaction helps realize Hunt's strategy to redeploy capital into best-in-class operating businesses, real estate assets, and infrastructure assets.

New Services for U.S. Military

Hunt and Amber acquire a majority interest in City Light & Power, an electrical contractor, and owner of utility systems specializing in the provision of services to the U.S. military under utility privatization contracts.

ESG Initiative

Hunt launches an environmental, social, and governance (ESG) initiative - formalizing its long-standing commitment to corporate social responsibility.

Property Management Changes

Hunt sells its majority interest in Pinnacle Property Management Services to Cushman Wakefield. At the time of the sale, Pinnacle had 169,000 units under management and was the third-largest third-party multifamily property manager in the U.S.

Family Foundation Gift

The Woody and Gayle Hunt Family Foundation, as part of its $5 million commitment, announces the sponsorship of the El Paso Children's Museum and Science Center's most defining feature - the 50-foot Anything's Possible Climber.

Building for the Future

Hunt celebrates the completion and grand opening of WestStar Tower at Hunt Plaza, Hunt's new corporate headquarters in El Paso, an initiative central to the Company's focus on social impact investing in its hometown.

75th Anniversary

Hunt celebrates its 75th Anniversary.

HMC Acquires AMCC

Hunt Military Communities expands its footprint by acquiring the AMCC portfolio, adding 7,900 homes across 19 military installations.

Boyd Watterson & Amber Strategic Combination

Boyd Watterson and Amber Infrastructure join forces to form a global investment platform with over $35 billion in assets under management.

Leadership Advancements: Ryan McCrory & Brian Stann

Ryan McCrory is promoted to President of Hunt Companies, and Brian Stann, CEO of Hunt Military Communities, joins the Executive Committee. Their leadership marks a new chapter of strategic growth, innovation, and operational excellence across Hunt’s diverse platform.

Strategic Growth: Carter & Inman Solar

Hunt Companies acquires a majority stake in Carter, enhancing its mixed-use development platform, and makes a strategic investment in Inman Solar to expand its footprint in renewable energy.