Hunt Capital Partners, the City of Buford Housing Authority and Paces Preservation Partners Embark on Two Georgia Affordable Housing Developments

May 25, 2023 • 5 min read

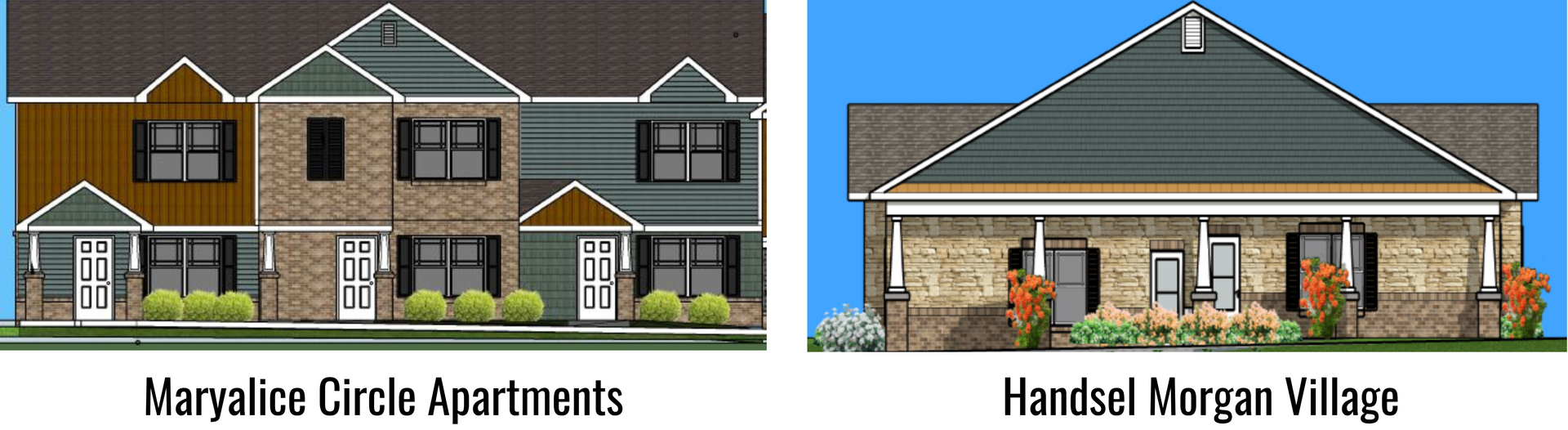

BUFORD, Ga., May 25, 2023 – Hunt Capital Partners (HCP), the City of Buford Housing Authority (BHA) and Paces Preservation Partners, LLC (PPP) — a collaboration between The Paces Foundation, Inc., a nonprofit based in Smyrna, Georgia, and Soho Housing Partners, LLC — announced the closing of Low-Income Housing Tax Credit (LIHTC) equity financing for two properties: Maryalice Circle Apartments (Maryalice) and Handsel Morgan Village (Handsel), both located in Buford, Georgia, a suburb located 33 miles northeast of Atlanta. Together, the two developments will create a combined mix of 143 homes, each offering quality affordable housing options for family or senior households earning up to 60% of the area median income.

HCP is providing $25.39 million in both Federal and State LIHTC equity financing for Maryalice, a scattered site property that combines the acquisition and rehabilitation of Trail View/Circle View apartments — an existing 70-unit public housing development — with new construction. Ten new units will be built at the north end of the property and 18 additional units will be constructed at another site 0.8 miles away at the intersection of Arnold Street and Forest Street.

HCP is providing $25.39 million in both Federal and State LIHTC equity financing for Maryalice, a scattered site property that combines the acquisition and rehabilitation of Trail View/Circle View apartments — an existing 70-unit public housing development — with new construction. Ten new units will be built at the north end of the property and 18 additional units will be constructed at another site 0.8 miles away at the intersection of Arnold Street and Forest Street.

As a part of the Department of Housing and Urban Development’s (HUD) Rental Assistance Demonstration (RAD) Program, the former public housing unit subsidy will be converted into a Section 8 Project-Based Voucher (PBV) subsidy, whereby family households will pay rent based on 30% of their income and HUD will pay the rent difference. Upon completion of the new units and the substantial renovation of the existing units in July 2024, Maryalice will offer a total of 98 affordable homes, consisting of 14 one-bedroom, 28 two-bedroom, 44 three-bedroom and 12 four-bedroom housing options, spread across one- and two-story, townhouse-style buildings.

HCP is also providing $11.48 million in both Federal and State LIHTC equity financing for Handsel, a new construction development consisting of 12 one-story buildings that comprise 10 quadplexes, one triplex and one duplex. When finished in July 2024, Handsel will offer three one-bedroom and 42 two-bedroom housing options for seniors ages 55 and older. Of the 45 units, 42 units will be subsidized by 20-year Section 8 PBVs, through which senior households will pay 30% of their income toward rent. As a RAD conversion project, Handsel will replace units being retired by the BHA.

“We are pleased to assist Buford Housing Authority in the development and redevelopment of Maryalice Circle Apartments and Handsel Morgan Village to further its strategic effort to build and preserve more affordable housing in its city,” said Hunt Capital Partners Executive Managing Director Dana Mayo. “Both properties are part HUD’s RAD conversion program, with which HCP has extensive investment experience. Maryalice and Handsel will significantly improve the standard of living for Buford families and seniors through increased accessibility options for households with disabilities, essential on-site supportive services and energy efficient amenities that enable reduced utility costs.”

Both projects offer set aides that provide enhanced accessibility to better serve families and seniors with a disability. Maryalice will set aside one unit to accommodate a family with hearing or visual impairments and five units for families with mobility impairments. Additionally, 39 units will incorporate roll-in showers as a key accessibility unit feature. Handsel will have three units for mobility impaired seniors and one unit for a sight/hearing impaired senior. For both developments, BHA and PPP will offer social and recreational programs for residents, including on-site enrichment classes, health classes and other services, as approved by the Georgia Department of Community Affairs (DCA). In addition, as a part of the Handsel transaction, one of BHA’s current public housing developments will be demolished with those units transferred to Handsel and the former public housing site will be redeveloped as a part of a new 10,000 seat football stadium for Buford High School.

Maryalice will pursue environmentally conscious and sustainable practices and seek a Sustainable Gold Certification under the EarthCraft program, which is the first multifamily specific green building program in the nation. To achieve this standard, Maryalice will work with i3pv, LLC — an EarthCraft House Technical Advisor — to develop a detailed compliance worksheet. Likewise, Handsel is designed to meet the 2015 International Energy and Conservation Code with Georgia amendments. Additionally, both developments will implement Energy Star Appliances, LED lighting and water sense-certified fixtures.

BHA and PPP are serving as co-developers for Maryalice and Handsel. Their development team also includes Fyffe Construction Co. as general contractor and Wallace Architects, LLC, as project architect.

The total development cost is $41.51 million for Maryalice and $18.04 million for Handsel. Hunt Capital Partners raised the Federal and State LIHTC equity for both developments through its multi-investor fund, Hunt Capital Partners Tax Credit Fund 48. Additional financing for Maryalice includes a $17.35 million construction loan from EastWest Bank (EWB) and a $5.90 million construction-to-permanent loan from Greystone Housing Impact Investors, LP (Greystone). Additional financing for Handsel includes a $7.96 million construction loan from EWB, a $2.15 million construction-to-permanent loan from Greystone and a $3.90 million Capital Funds construction-to-permanent loan from BHA.

Environmental Social and Corporate Governance (“ESG”) Investing

Hunt Capital Partners recognizes that its institutional investors are seeking to increase the social value of their investments to help further their ESG initiatives. An investment in affordable housing not only improves the living conditions of its residents, but it also helps to remove obstacles that stand in the way of creating a healthy, safe and stable home environment for low-income families and seniors. When families spend less on housing related expenses, they have more resources available for other essentials such as food and clothing, or even extracurricular activities and educational programs. One of the most significant benefits to providing quality affordable housing is an increase in an individual’s physical and mental health. Hunt Capital Partners’ affordable housing investments create a lasting effect on the people and communities they serve for generations to come.

About Hunt Capital Partners

Hunt Capital Partners (HCP) is the tax credit syndication division of Hunt Companies, Inc. (Hunt). HCP specializes in the sponsorship of Federal and State Low-Income Housing, Historic, and Solar Tax Credit Investments funds. Since its inception in 2010, HCP has raised over $3 billion in tax credit equity in over 48 proprietary and multi-investor funds. HCP manages almost 760 project partnerships representing over 75,000 homes in 51 states and territories. Founded in 1947, Hunt is a privately held company that invests in businesses focused in the real estate and infrastructure markets. The activities of Hunt’s affiliates and investors include investment management, asset management, property management, development, construction, consulting and advisory. For more information on HCP, please visit www.huntcapitalpartners.com, or for Hunt, please visit www.huntcompanies.com.

Share this post